🎄 A 2021 Holiday Gift Guide 💐

A Holiday Gift Guide for the person in your life with exquisite taste and a love for flowers 💐

Read MoreA Holiday Gift Guide for the person in your life with exquisite taste and a love for flowers 💐

Read More

I wanted to create a resource where small business owners can find information in both English & Spanish to help guide them through important decisions for their business during this time. All of the information below is available to anyone. Struggling small businesses should not have to pay to obtain this information or pay anyone to help them apply for any of this.

Quise crear un recurso en donde dueños de negocios pequeños puedan encontrar mas información en ingles y en español para guiarlos con las decisiones importantes que tienen que tomar durante este tiempo para su negocio. Toda esta información esta disponible a cuál quiera persona. Dueños que están luchando para mantener su negocio abierto no tienen porque pagar para obtener la información y tampoco pagarle a nadie para llenar estas solicitudes.

“And for the more vulnerable non-english speaking communities we need to make more resources available”

Below you’ll find/ Aquí encontrara:

1. How to apply for CA Pandemic Unemployment if you are a business owner or self-employed/ Como presentar su solicitud de Desempleo por la Pandemia si es dueño de un negocio o contratista independiente en CA

2. Links to freelance & small business relief funds/ Aplicaciones para ayuda de negocios pequeños

3. Small business loan Application ( PPP, EIDL)/ Solicitud de préstamos para negocios pequeños

How to apply for CA Pandemic Unemployment if you are a business owner or self-employed/ Como presentar su solicitud de Desempleo por la Pandemia si es dueño de un negocio o contratista independiente en CA

“If you are a business owner, independent contractor, self-employed worker, freelancer, or gig worker and only received a 1099 tax form last year, you are most likely eligible for PUA.”

“Sí es dueño de un negocio, contratista independiente, persona que trabaja por cuenta propia, trabajador independiente o trabajador de la economía colaborativa y sólo recibió el Formulario 1099 el año pasado, probablemente sea elegible para PUA.”

What you need to have on hand to fill out this form/ Lo que ocupa tener en mano para llenar esta aplicación:

SSN (Numero de seguro social)

Drivers License Number (Numero de Licencia)

If not a US Citizen, proof that you are allowed to work in the US (Prueba de Ciudadanía)

Gross Earnings from last years taxes (Sueldo total que gano y reporto en sus impuestos de el ano pasado)

This link will guide you on how to answer specific questions in the application.

Esto lo guiara en como responder preguntas especificas en la aplicación.

Before you fill out the application you have to register & create an account first. Make sure you use an email that you have access to because you will receive email notifications.

Start HERE

Antes de que llene la aplicación necesita registrase y crear una cuenta. Use un correo electrónico que usted tenga acceso porque le van a mandar notificaciones.

Empiece AQUI

2. Links to freelance & small business relief funds/ Aplicaciones para ayuda de negocios pequeños

Below are a few links to Small business relief funds that could help your business.

Abajo ay enlaces para ayuda de a negocios pequeños que le pueden ayudar a su negocio.

GO FUND ME + INTUIT QUICKBOOKS Small Business Relief Initiative

LISC Verizon Small Business Recovery Fund

LISC Verizon fondo de recuperación Negocios Pequeños en español

3. Small Business loan Application ( LA Small Business Microloan & PPP)/ Solicitud de préstamos para negocios pequeños

Los Angeles City Small Business Emergency Microloan Program

Programa de microcréditos de emergencia para pequeñas empresas de la ciudad de Los Ángeles

This loan has limits between $5,000-$20,000. It also has 3 options for interest repayment with terms between 18 months and up to 5 years. Eligible Businesses should be located in a commercial–use building within Los Angeles city boundaries. HERE you can determine if your business is within the zone.

Este préstamo tiene limite de $5,000-$20,000. También tiene 3 opciones de tasas de intereses con términos de 18meses asta 5 anos. Negocios elegibles deben ubicarse en un edificio de uso comercial dentro de los límites de Los Angeles. AQUI puede determinar si su negocio esta adentro de la zona.

SBA Paycheck Protection Program Loan Information/ SBA Programa de Protección de Pago

HERE you’ll find the requirements to verify you’re eligibility for this loan

AQUI encontrara los requisitos para saber si usted puede aplicar para este préstamo

An important thing to keep in mind when applying for this loan is that it is only forgivable if you keep all of your employers on payroll along with other guidelines. “Forgiveness will be reduced if full-time headcount declines, or if salaries and wages decrease.”

Tome en cuenta que este préstamo es perdonable si los fondos se usan para mantener y pagarle a sus empleados y también ay otras pautas. Entre mas empleados que usted descanse, o si usted le baja el salario a sus empleados mas le van a bajar los fondos disponibles para ayudar a su negocio. Las solicitudes deben presentarse en inglés.

The past couple of months I’ve helped different business owners file for Pandemic Unemployment, & translated Small business relief loans + documents. Most small business owners who a struggling to keep their business open during this time are either misinformed about what resources are available to them or not approved for loans that larger corporations & businesses are being granted. We need to keep our community informed. And for the more vulnerable non-English speaking communities we need to make more resources available, especially on the Small Business Administration Website. This would help avoid business owners getting scammed & make educated decisions based on their business and financial needs. We need to take care of our local business owners & support them during this time. You can help by shopping locally & sharing this resource with anyone who needs it.

I hope the information is helpful and if anyone needs further help please reach out to me through the contact form on the website. I will be helping Spanish-speaking small business owners with any documents or applications they need translated at no cost & I will be updating this resource as I find more helpful links.

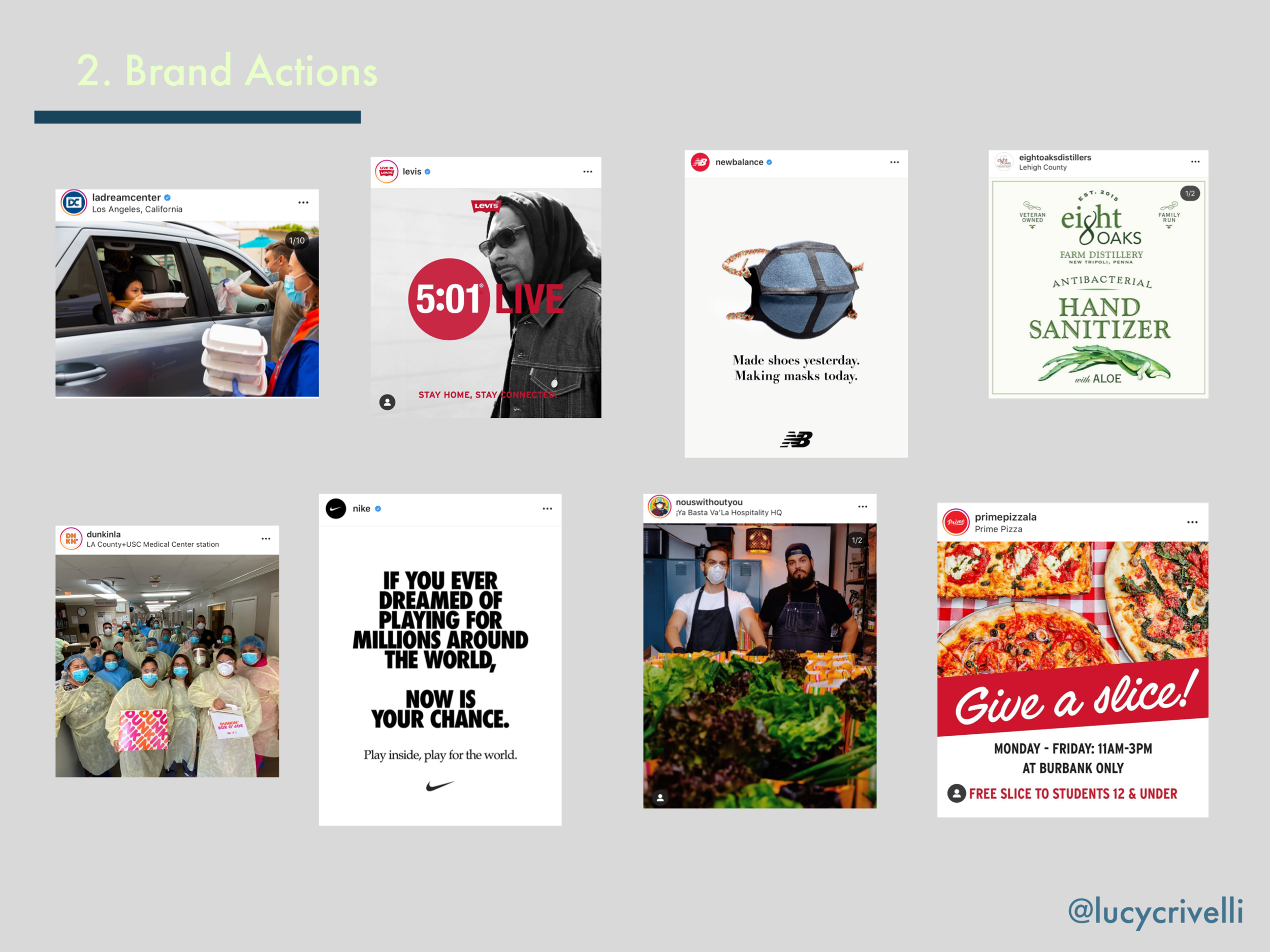

I wanted to create a resource to help guide big and small businesses during this crisis, & strategize around the changes in marketing, social media, and business.

Below you’ll find ideas and helpful tips on how to switch up your business strategy. It focuses on what you can do as a business owner to boost your engagement, and keep your digital presence.

N

ATE ROOTS

“I’m creating but in a different field. All which are hugely important and I’m constantly inspired to do.”

L: Tell us a little about your background; how & where were you raised, your current role, how you create-

N: I was raised in Palmdale, California within a very active household. My siblings are all bold and strong willed individuals and my parents are the same. Sounds cool, but that lead to endless disagreements amongst all of us. My pops plays a huge role in my life both negatively and positively. One of the many things he’s known for is a builder. He did construction and built homes as a side hustle. Pops would gather the boys in the house and we’ll all go complete whatever job he had for the weekend. I seen how critical it is to believe in yourself and that you can learn to do anything. My mother showed me fearlessness. She pursued whatever idea that came to mind and did the necessary research and study to be qualified for the task. She’s lit. I’ve seen both my parents succeed and fail in front of the family and that taught me so much. My love for music comes from my Pops. I loved how much he loved music. He collects music and makes his own mixtapes of Jazz, soul, and oldies. It’s the most tasteful selection of music ever! The music in the house was one of the ways the boys connected with each other. It meant a lot to me.

L: What inspires you to create?

N: Almost everything inspires me to create music. I’ve been at it for so long that it’s like waking up and brushing my teeth. There’s a day that goes by and you ain’t brushed yo shit, but 99% of the time you do.

Let me flip this! What inspires me not to create music is when my spirit is aware of the need to create in another field of life. For example, creating a specific environment within my home, and creating a fun dynamic within my marriage. Still, I’m creating but in a different field. All which are hugely important and I’m constantly inspired to do.

L: What has been the highlight of your career?

N: The highlight of my career was becoming aware that my gifts are for others and not myself. The more I increased my capability to help others the more popular I became. This gave me a strong purpose for my talent and was a highlight moment for me.

L: Who are the top 3 people you look up to?

N: Top 3 people I look up to are my brother Pj, Dj, and my uncle William. The reason I look up to these guys is that their heart is made of pure gold. Selfless love! They are there for you! People should write a book about these 3 men. I hope to live a life filled with love like these guys.

L: How do you hope to leave your mark, & inspire others?

N: I’m leaving my mark in this world by leaving love’s fingerprints on everything I come into contact with. All living things receive love and I choose to use love as my tool to create and impact the world. Boom! Shabang dadang!

Geza & I met Nate Roots through his now wife Janelle. His energy was so good, no other way to explain it but pure good for the soul energy. I think the most important part of this friendship was all four of us being in each others lives through big breakthrough moments. Nate is not only a full-time friend to all but also an amazing creator. His music inspires both Geza & I! His vibe is always lit, anytime we hear a new beat he created we instantly think of video concepts we can create to go along with his music. His authenticity is his biggest asset. He is 100% himself, and that is something I look up to.

Thank you Nate for being family and constantly supporting us! We’re here for you homie.

You can follow and vibe with Nate here

The Hi-Vis Interview Series will shed light on the late night creators on our own team that truly embody the Nite Jogger story. Through sharing their own stories and passions, we’ll give visibility to these agents and show how they balance their roles during the day and purusing their creative endeavors in the nite.

Growing up in Allentown, Pennsylvania, Geza Frey found inspiration from a broad scope of influences.

From watching Michael Vick tearing NFL defenses to pieces, to the music around him from his father - a local DJ, who owned the night life scene in his area, seeing those that influenced him in different disciplines breaking molds and challenging the status quo inspired Geza to want to do the same. Through his work as a content creator and creative consultant through his social channels (@itsgeza) he is doing just that. Working with brands and retailers from Champs to Foot Locker and Finish Line, as well as his own passions in music, gaming and tech, Geza embodies the mindsight and story of the Nite Jogger’s, “Late Night Creator” as he considers the time to pursue his creative passions as, “the second I clock out.”

Who are you in your role as a Field Agent, as well as who you are at night when you’re pursuing your vision?

As a field agent, I try to bridge the gap between the consumer & the brand through retail. I build relationships with associates & managers to not only create advocates for the brand but to enhance their overall view on adidas a whole. I’ve dealt with sleep issues since I was a kid, but I’ve used this extra time to develop creative habits that allow me to thrive in night time. I’ve used something negative and turned it into a positive by investing my sleepless nights in brainstorming and creating new ideas on how I can use my website, social media, networking, personality, and brand partnerships to make a more significant impact on the things that matter to me.

The story of Nite Jogger is, “It’s Never too Late to Pursue Your Vision.” What does that mean to you in your own creative pursuits?

For me, every day is a new opportunity to do or learn something new. I think fear is the one thing that sets a lot of people back from pursuing their vision. The first step is always the hardest, but it can be monumental. The story of the Nite Jogger defines that first step to success. Although I know the road to success requires sacrifice, risk, and hard work I’m willing to take it because the reward is the influence it’ll have on a kid like me that’s scared to take on something new. Time is the only currency that cannot be replaced, and I'm trying my best to invest the time I have to continue to grow, learn, and pursue my vision.

How do you find a balance between your role as a Field Agent as well as pursuing your personal creative goals? Are they related?

For me, integration has been vital for balancing my role as a aFA and my creative goals. When I earn an opportunity to partner on an Ultraboost 19 campaign w/ footlocker while we are advocating in stores during drop week, it allows me to tell an authentic story to associates, consumers, and followers (who can all become one in the same) and have an impact way beyond my local territory. I try to create unboxings, photo sets, and tech videos for Instagram that I can share w/ those employees that aren't able to make the tech clinic.

What’s your favorite aspect of Nite Jogger, and this story that the brand is telling?

Being from a city like Allentown, I know what it's like to be slept on. The High Visibility details are essential to me. We bring the light, and the subtle hints of reflectivity stand out to me in the Nite Jogger. An almost forgotten silhouette, now a Blockbuster is turning heads and is one of the most sought after sneakers of the year. I love that the brand is highlighting creators of the night and making this a staple for nightlife fashion. The Nite Jogger campaign also has an emphasis on inspiring creators to expand their talents and create in the night. This point really hits home for me.

Nite Jogger is our Blockbuster Originals launch for SS19, with the storytelling and symbolism of the shoe being at the center of the launch, how are you bringing that story to life in your market and with your store teams?

When I get the shoe in hand, I want to create a resource video that I can bring into my stores and beyond. Teching out an average of 12 people per door is great but the impact that a 1000+ views on social media along w/ tech clinics can make retention and brand awareness so much higher in my region. My resource video would break down the tech and story behind the Nite Jogger.

Integrating your passions into your work, taking creative risks and investing into yourself to pursue the things you want to achieve.

DANNY McNABB

“ I also hope to inspire anyone to “decide.” No matter what your dream is, it starts with an unwavering belief that you can succeed and compete amongst the best. Just decide. ”

L: Tell us a little about your background; where you were raised, your current role, how you create:

D: I’m Danny Mcnabb. Born in Zimbabwe, bred in California. I moved to the states in third grade and fell in love with sports and fashion culture. My mom raised me as a single parents and taught me all the foundational elements that have helped me through life, the most important being to always question the way things can be done. I played on travel baseball teams until I was in High School and then dabbled in Water Polo and Soccer in between baseball season. Early on in High School I was also running a T shirt company called Rype clothing, which introduced myself to my entrepreneurial spirit and taught me how to network properly.

After HS I went to Junior College to figure shit out and ended up getting a baseball scholarship to a small school in Oregon. I ended up rooming with a kid named Matt who would become a business partner a few months after we met. During our free time between school and baseball we put our heads together and realized we could flip Nike’s from the Oregon outlet’s, online (eBay), risk free. There was no tax in Oregon either so we were scoring crazy deals and finding some super rare items in the outlets.

We would buy shoes in bulk, list them and if they didn’t sell, we would return them for full refund. This became a full time hustle between baseball and it really helped us learn about business, stack cash and ultimately were able to get college units from the business school for presenting the business plan and all accounting. Flipping sneakers grew my love for the culture that came with and sooner than later I was hooked.

We quickly moved from selling sneakers into the world of marketing, as we realized margins were much higher if we helped brands sell shoes instead. We were in the Portland area, surrounded by all these creative agencies doing big projects for Nike and adidas. After each trying to get a job and being laughed at for lack of experience we realized, we needed to just create our own instead. Shortly there after, we launched a creative agency called Andrew x Paul with all our friends who were creating in the photo and video space, so we could look much bigger than we were and started sending out pitch decks to people who worked for brands. A couple small projects later and a full year from sending the first email, we got our first big reply from Foot Locker. From there we established that we could create sneaker focused content, cheaper and more authentically than the companies they were using- and we haven’t stopped since. Using that work we were able to bring in some other clients and grow the portfolio. During that time I was able to nurture a relationship with an agency called Archrival and figured out a way that I could come on full time as a content producer for them. They blessed me with the opportunity to work from home and still work on my side projects. I’ve been grinding with Archrival since then and it’s been such an incredible experience learning from some really talented creatives. We ended up closing shop on our agency, Andrew x Paul and have each been doing our thing solo now. Still working together when it makes sense.

My roles with Archrival and my side projects always change with client needs, but my true passion is in Creative Directing visual content. This past year I was able to switch gears a focus more on bringing visuals to life and I’ve never been happier. Being able to own the creative direction from start to finish is really where I feel I thrive, and to have brands trust me is something I’m forever grateful for. That said, you will still catch me behind the lens, shooting photos and videos for brands when needed. It’s 2020 - who say’s you can’t do it all?

Danny was the Creative Director of the shoots shown above.

L: What inspires you to create?

D: I’m inspired by people. I love seeing what a human can do and how they can completely rethink/innovate something. I’m extremely inspired by South Africa as well. In the past 10 years, they have been able to get their hands on technology and supplies that we take for granted and it has evened the playing fields a bit. We are seeing a whole new level of creative thinking coming from the art community there. They always made things work - now they get the resources to create even greater things. The world is starting to take notice. I’m also inspired by the projects I get to work on, and the pressure of knowing that in the agency world you're only as good as your last idea. I love that pressure, it feels like I’m back playing a sport, and helps me kick into a new gear.

L: What has been the highlight of your career?

D: Footlocker gave me the opportunity to direct a Nike commercial for their Swoosh pack campaign. That was the most trust a brand has put in my hands and it opened a lot of doors for me.

L: Who are the top 3 people you look up to?

D: My Mom, my mentor Jon Reisinger, & Bobby Hundreds.

L: How do you hope to leave your mark, & inspire others?

D: I hope to one day create a video commercial that becomes a staple in our timeline. A piece that blends culture and sport effortlessly with a game-changing message. I also hope to inspire anyone to “decide.” No matter what your dream is, it starts with an unwavering belief that you can succeed and compete amongst the best. Just decide.

One of the main reasons I wanted to highlight Danny is because of his way of showing support for others. In the short amount of time I’ve known Danny he has been an inspiration for Geza & I. He continues to set an example for young creators to support each other and help each other win. I think more than anything, his positivity and talent shines through every project he works on.

Thank you Danny for wanting to be a part of this community of creators!

follow Danny on Instagram

Welcome to Community + Collaboration. This is a creator’s series to highlight genuine men & women in multiple industries for their work & individuality. We chose to feature people who have inspired us, as well as their own communities. We think these creators deserve more spotlight not only for their work, but the overtime they put into their craft. This is an opportunity for us to show that there is room for growth as a community, & there is room for EVERYONE to win. We hope that “Community + Collaboration” inspires you, we want you to see the struggle, the hustle, and the come up.

JAZMYN LE

“Don’t follow, don’t try to impress, and don’t do anything that doesn’t feel like you.”

My name is Jazmyn Le, everyone calls me Jaz. I was born & raised in Las Vegas and still reside here as a Lead Photographer for ZEN (@zen). I've been in the streetwear industry for 12 years which led me into photography (shooting for about 10 years). I started off shooting plain product photos of t-shirts on tables for blogs then slowly moved my way up to professional online/on model photos, then to product photos for social media, all the way up to directing/shooting editorials which is my current role now.

L: What inspires you to create?

J: When I see something new or out of the ordinary I always put into perspective how I can incorporate something like that into my projects. Whether it's from food, fashion, or art, my eyes are always open to anything and everything that can excite me. If I am able to be the first to open someone's eyes and show them something they've never seen before then I'm satisfied.

L: What has been the highlight of your career?

J: As of right now I think the highlight of my entire career was working for KNYEW ("Keeping New York Everywhere," streetwear boutique created out of Las Vegas). It was really a breakthrough for me. I started here as a shop girl at 18 and left when I was 27. I applied for this job to get me through dental school. While working here I learned a lot about all of the ins and outs of a business. It was like a boot camp to train me for the future. Some days I would work 12-14 hours a day. I went from every role from cleaning the stockroom all the way up to VP of the company. This place taught me people skills, organization, managing, marketing, and everything else in between. I built a lot of important relationships I still take with me today, which I am very grateful for. Working here has molded me into the person I am now. I realized my passion was to stay in the creative industry.

L: Who are the top 3 people you look up to?

J: The first person I look up to is my aunt, who showed me how to be mentally strong and honest. She taught me how to work hard and to be unapologetic about who I am. Being a mother I now really appreciate my mom and realize all the things she has done for me and my brother. It isn't easy especially as a single mother. The last person I look up to would be my previous boss and good friend Crooked. I spent a lot of time with him over at KNYEW, he showed me a different way to look at life, to train my brain to look at all the possibilities and aspects of a situation.

L: How do you hope to leave your mark & inspire others?

J: I hope to leave my mark through my work. I like my work to speak for itself. I hate promoting myself to others and talking about myself to get gigs, etc. Through my work and my art, I want people to see that I am versatile, hardworking, and serious about what I do. I would like to inspire others by showing them that if you stay true to yourself in the end it'll pay off. Right now social media is impacting people; some good, a lot bad. Don't believe everything you see on the internet. Don't follow, don't try to impress, and don't do anything that doesn't feel like you.

I wanted to highlight Jaz because she inspires me to do more with my photography. I know her only through Instagram, I followed her a couple years back and have kept up with the growth of her career. It is rare in the fashion/sneaker industry to have women photographers. She’s pushing the boundaries for female creatives to be looked at and respected. She’s a full-time mom and full-time creative but wears it so well. Her work shows the amount of sacrifice and time she has put into her craft.

Thank you Jaz for being a part of Community + Collaboration!

Welcome to Community + Collaboration. This is a creator’s series to highlight genuine men & women in multiple industries for their work & individuality. We chose to feature people who have inspired us, as well as their own communities. We think these creators deserve more spotlight not only for their work, but the overtime they put into their craft. This is an opportunity for us to show that there is room for growth as a community, & there is room for EVERYONE to win. We hope that “Community + Collaboration” inspires you, we want you to see the struggle, the hustle, and the come up.

Mark Godbolt

““...and always seek collaboration. It’s a family. One day we may get chains made. Or, maybe not because we’d want to set a new tradition that goes even deeper. “”

Our first feature is Mark Godbolt. We only knew Mark through Instagram, until we met up with him in Portland & talked about all things sneakers, fashion, & life. It hit home when we realized why God had placed him in our lives. He is a genuine father, husband, and friend. He has inspired us to continue creating, continue growing, & most importantly continue praying. We follow Mark not only because he’s our friend, but because we believe in his self-made brand. He is all about community and putting people on. We hope he can inspire you as much as he inspires us.

L : Tell us a little about your background; how & where you were raised, your current role, how you create-

M : My upbringing. I grew up in Oak Cliff, TX, and without many outlets of survival outside of Football and school. I didn’t know that I could create a living for myself via Nike - let alone through my own brand. Today, people will see another way if they have the passion to do it.

L: What has been the highlight of your career?

M: The highlight of my career has been the Nike EQUALITY Promo project. It literally started as nothing and grew into a life-changing moment. Oh, and it was wearable.

L: Who are the top 3 people that you look up to?

M: Number #1 and not cliche’ at all. Or maybe it is but who cares - is God. My life has changed drastically over the last couple of years and my relationship with God has grown stronger because of it. #2. My Fiancé. I’m so blessed to have a direct line to a strong black woman that’s smarter than me. She challenges me and adds so much to my perspective. Her work is top-notch and she’s honest. We go at it, and the results are legendary. #3 The FΣRM. It’s our collective group of young black creative minds. We challenge each other to be great ...and always seek collaboration. It’s a family. One day we may get chains made. Or, maybe not because we’d want to set a new tradition that goes even deeper.

L: How do you hope to leave your mark & inspire others?

M: I hope to leave my Mark by showing that anything is possible through Christ and by respecting everything and everyone. Whether creating for myself or others, it’s important to approach everything with that same level of “Godbolt” that shapes everything. There’s more noise about being something else than there is being yourself. I’m inspired by the same people I hope to inspire.

Thank you Mark for being a part of this.

Thank you to the readers, stay tuned for our next feature. Happy New Year!

Hey guys, huge update!

The wedding planning is officially finalized, with minor details to worry about; our wedding is coming together. So now we're moving onto the fun part, the Honeymoon.

The plan is to go to Europe; hit Paris, then Spain, Rome, & back to France. It'll be our first time in Europe; we've both traveled out of the country but never together. We've had this trip on our bucket list for a while, so what better time to go than on our honeymoon.

What we have so far, is a plan of what flights to book, what area to stay in, & how much we want to spend. We are currently making a list of what to bring, how to dress, & how to pack.

What we need from you guys is to give us some suggestions on places to eat, local attractions, picture-perfect locations, unforgettable experiences, & what are some must pack items.

Also, list your favorite brands, & airlines you use when getting ready for an out of country trip. Send us your favorite influencers that can be our virtual tour-guides for where to go when in Europe.

We are super excited to keep you guys updated once everything is planned!

At this point, it’s 5 months before the wedding. Crunch time. I think this is the part that should be easier because everything is coming together. But it’s actually a lot harder than we thought. This is the hard part that makes you realize why you’re marrying your significant other. The stress of the process, the planning, the decision making. It all shows you why you’re together, and how you’ve gotten this far.

A lot goes into planning a wedding. You have to try & throw an amazing wedding, stay within a budget, plan a honeymoon all while trying to turn off your ears to what everyone else has to say about YOUR wedding. I want to say this process has been easy for us, but that would be giving you guys a false idea of what wedding planning is really like. It’s fucking stressful but has its fun moments at the same time.

So for a fun little read and to relieve you of some stress; we’ve compiled 4 things to consider when planning a wedding.

If you don’t have thousands to blow on your wedding, don’t worry about pleasing others with all that cash. Your wedding day can be simple but glamorous at the same time. It’s all in the details. Don’t go broke trying to have your dream wedding. Unless you got it like that or found a rich honey, save that shit for your honeymoon! You’ll thank us later. (Yelp, Etsy, Amazon, Moo, Canva, are just a few places to start getting creative)

Don’t call off the wedding if stress is getting too hot to handle. Although it's very typical, it will also cause tension between the both of you. Take a second to think if what you’re stressing out about is worth stressing yourself out and your partner. Stress isn’t healthy so throw a little fit, refocus, and get back to planning.

Typically the bride plans most of the wedding, but it's important to remember you’re BOTH getting married so responsibilities should be shared. This takes a huge weight off of the bride's shoulders & it honestly keeps you both on the same page about what will be happening on your special day. Sharing every detail about the wedding & coming up with creative ways to make your day memorable makes it that much more fun and exciting. Find each other strengths and weaknesses to evaluate who will take care of what. You’re not going to agree on everything, but you’re different people with different thoughts, talk it out and get through it.

Enjoy the good and the bad. Hopefully, you’re only planning on getting married once, so this should be something you’re fully invested in. You have to learn to love the ugly because not everything is going to go as planned. Every moment counts & it's those hard to get through moments that are going to make your day extra special. You’ll look back at the finished product while you’re sitting beachside sipping some chardonnay thinking to yourselves “it was worth it”!

And while I sit here skimming through all of the wedding emails, I can't help but be thankful for having the perfect person to go through all of this with.